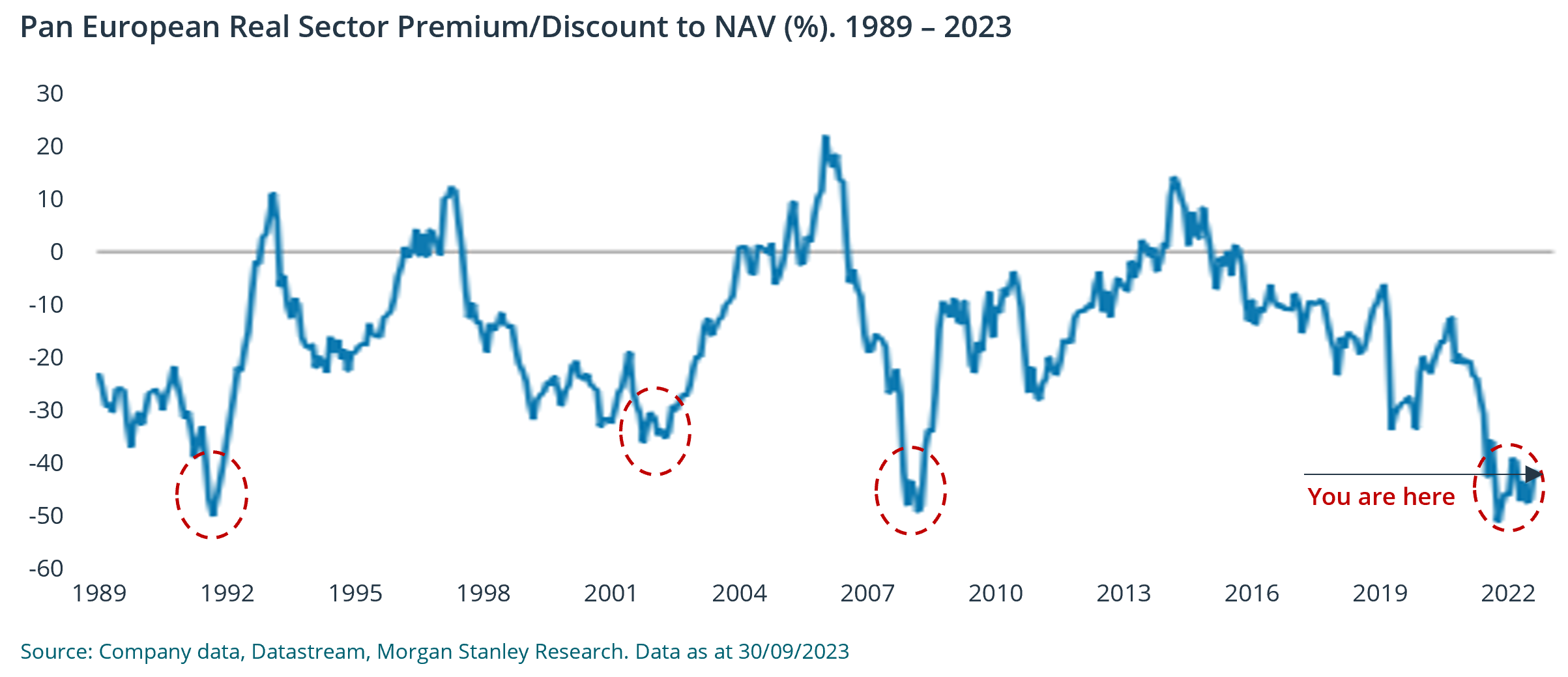

It doesn’t take a genius to work out why the stock market has fallen out of love with real estate. A one-two punch of steepening interest rates and working from home has had a ruinous impact on the market, with pressure building both on the top and bottom lines over the past few years. The effect has been that the European real estate sectors (yes, plural) now trade at a Great Financial Crisis-esque discount to net asset value.

In fact, the current discount has only been reached four times since 1989 and, after each time, the sector has sharply bounced back.

Of late, a combination of recent results and market prices suggest it might not be all doom and gloom for the world of lanyards, hot desks and awkward water cooler chatter.

There’s no doubt that the real estate sector finds itself, to quote George Clooney’s character in O Brother Where Art Thou?, “in a tight spot”. NAVs are down, some offices are empty and it’s almost impossible to escape negative headlines over major firms leaving their flagship office buildings. However, as any seasoned investor knows all too well, one should never, ever invest in the present and there are tentative signs of a recovery emerging already.

Take FTSE 100 stalwart Land Securities’ recent results, in which it mentioned “office re-engagement is coming back, with the amount of unique daily turnstile taps reaching new highs in September and October…there has been a 22% increase in office footfall in 1H23 vs. 1H22.”

Similarly, Colonial, a European operator with assets across Spain and France, saw its occupancy rate rise 168bps YTD to 97.4% in Q3. Bears might retort here “well, what about pricing?”. In fact, reversion rates – the prices at which existing leases are reset – were up 6% for its commercial offices (and 11% in merry Paris). The Spanish-listed operator has even been able to pass inflation on to all the contracts to which it has applied indexation, with an average rent increase of 5%. Recent office leases are showing pricing power too, with signed leases in the third quarter 9% above December 2022 rental values on average, the third sequential rise this year.

For those fortunate enough to be wining and dining in the City of London, there’s also anecdotal evidence that getting a walk-in table might be a thing of the recent past. One Lombard Street, a brasserie located opposite the Bank of England, had its best trading day in its 25-year history in mid-October, recording just over £60,000 in turnover, according to the FT.

In terms of supply and demand, it’s becoming clear that most companies want their employees back in the office at least three days a week, with working-from-home (WFH) pin-up Zoom even demanding its workers return to their desks in August. We’re not going to delve too much into the “why” here, given the arguments for and against WFH have been discussed at length since 2020. However, it appears that the great office return isn’t just a C-suite driven phenomenon, with a survey by EGI citing social interaction as the primary driver as to why staff are returning. In hindsight, it seems the Rona Rig was a pretty lonely place to be spend your working hours.

The supply side also seems supportive, with both fear and higher financing rates weighing on construction. The CEO of Spanish real estate firm, Merlin Properties, summed it up well on its 3rd quarter conference call – “there is almost a non-existent new supply in offices -in Madrid at least- due to a wave of negativity on the sector from across the pond”. On the margin, conversions of buildings from commercial to residential – such as HUB and Bridges’ recent deal to purchase and re-purpose a London office for £39m – are also nibbling at supply.

There are obvious caveats here. First, there’s a clear polarisation between the best and the rest when it comes to commercial real estate assets. If a company wants to attract and retain employees, it goes without saying that a decent office is required. The vacancy rates in London arguably speaks to this with 40% of vacancies concentrated in just 1% of buildings, and 90% in 10% of buildings, per Land Securities.

Second, due to WFH, there’s a marked pattern of office occupancy with only 43% of staff spending five days in the office per week in the UK, according to recruitment firm Hays. In the short term, this will continue to put pressure on rents. However, as Land Securities recently said, to reiterate the above, it “is mostly a building issue, not a market wide issue”.

There is, of course, justified concerns about balance sheets. However, looking across the sector, debt repayment schedules are spread over years and inflation should attenuate some of the most severe impacts of these incoming maturities.

Yes, NAVs are down YoY but given what the shares are pricing, this is arguably not a big deal. To quote the Merlin CEO again, “our NAV is €15.50, and the shares are trading at €8.5, so there is no special problem with the NTA coming down a little bit”.

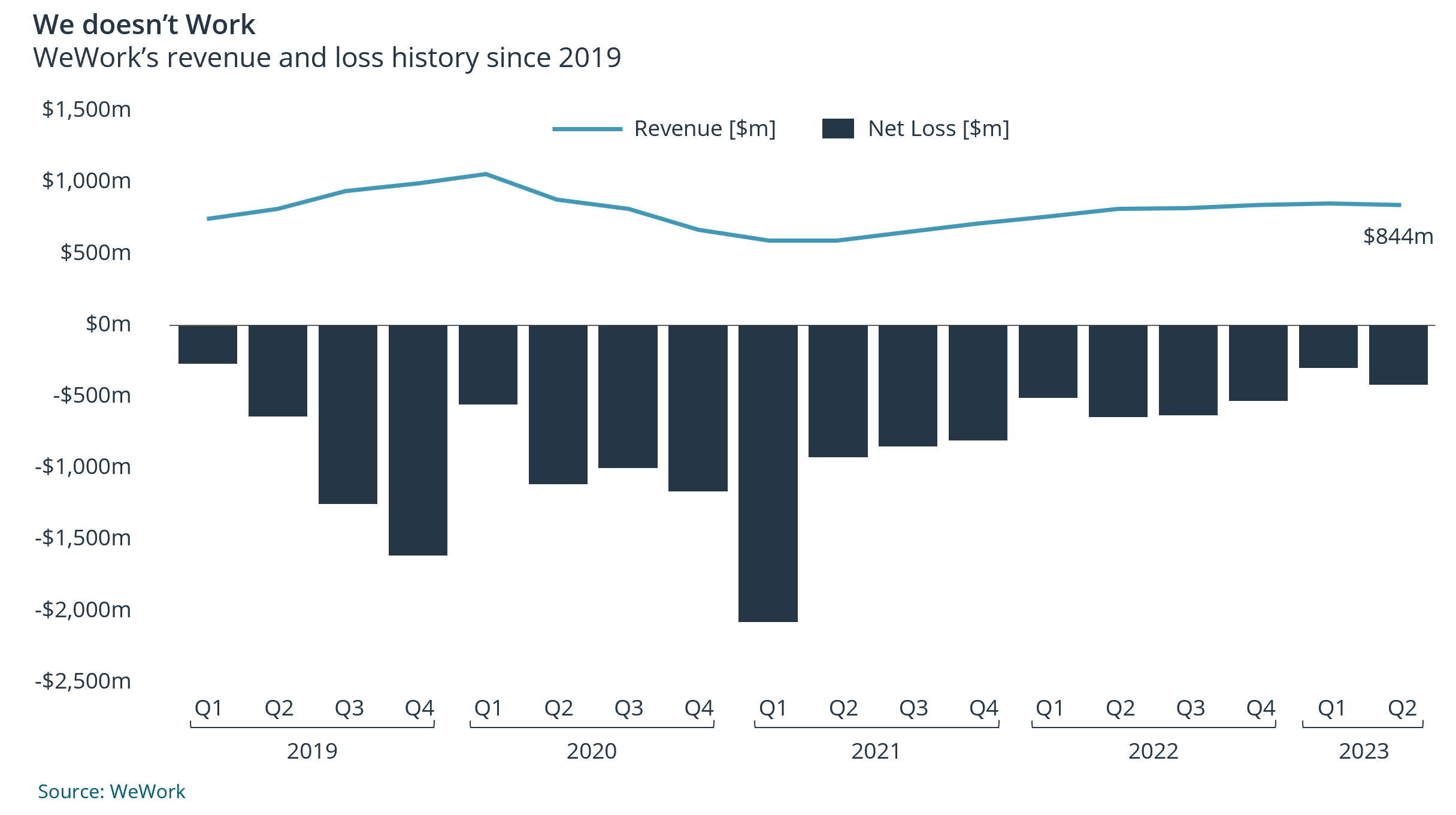

It is a well-known banking motto that the “worst of loans are made at the best of times”. Yet, perhaps, the opposite may also be true. The collapse of WeWork this month may, ironically, provide one of the best signals that the bottom is in.

Disclaimer: The views expressed herein are the views of the Princay team and not necessarily of Lansdowne Partners (UK) LLP as a whole. The content of this Article has been prepared by the Princay team alone and is not, and has not been endorsed or approved by any other person. The article and the information, statements, opinions, interpretations and beliefs contained in it are those of the Princay team and are provided in good faith, but no representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the contents of the Article, and no person shall be entitled to place any reliance on the Article or its contents. This Article is not intended to be, nor should it be construed as, investment, financial, tax or legal advice, or a recommendation to buy, sell or hold any security or other investment or pursue any investment strategy. Neither this letter nor any of its contents constitutes an inducement, offer or solicitation to purchase or sell any securities.

More Insights

Daniel Avigad explores what Europe can learn from Argentina’s radical reinvention under President Milei.

23 October 2025

Peter Davies spoke with Christian Mayes at Portfolio Adviser, who was interested to hear his views on why we believe UK banks represent a compelling contrarian opportunity

10 September 2025

Daniel Avigad discusses how political fragmentation and shifting regulatory structures are reshaping European investing and creating potential for long-term renewal.

28 August 2025