In this blog we will discuss our views on the impact of digitalisation within European equities.

Moore’s Law has unleashed unprecedented disruption. In 1969, Boeing launched its icon 747 jetliner at the same time as the first generation of modern computer chips like the Intel 1101 and the Intel 3101. If the Boeing 747 had developed in the same way as the semiconductor industry, you would now be able to travel a million miles an hour and a trip to New York would cost about $5. This type of advancement is unprecedented and has never been seen in any other industry.

While clearly this dynamic is of a global nature, there are a number of unique ways in which European economies will be shaped that we believe are not well appreciated.

European Equities: Three Ways Digitalisation Is Likely To Play Out

Firstly, digitalisation is inherently intertwined with climate change. It is a necessary pre-condition for opening up many of the pathways towards decarbonisation, thus spend on digitalisation is also going to accelerate and shares the same positive characteristics of a time-decay function that we described in our blog on decarbonisation. One of the central themes of decarbonisation is to ‘electrify everything’, i.e. the transition from fossil fuels to electricity. The use of energy in the form of electricity is inherently digital, whereby power semiconductors and power management systems play a central role in the efficient usage of energy sources.

Second is the response to the COVID-19 pandemic. The public sector is responding by trying to bail out the economy through climate-related stimulus and the private sector is trying to bail itself out by digitalising. Whole new industries are achieving critical mass, others are being disrupted as a result, which has been a long time coming in Europe especially. As labour and other costs rise, we see a renewed effort to protect corporate margins through rapid automation of business processes. Solution providers in the field of digital twins, online order management systems, and the general consulting services required to implement such digitalisation efforts are all reporting record business activity.

Third, demographics and politics are kicking in. Working age populations in most major economies will start to stagnate or shrink in the next decade for the first time. As the overall economic pie expands at a slower pace, the competition for share of the pie will increase. We expect labour and government to demand an increasing share to the detriment of capital. Signs are already visible obviously, how long will it be until the quasi-informal 4 day work week is made explicit?

In such an environment, high standards of corporate governance demands digitalisation and automation. Reliance on an external pool of labour where both price and volume is unstable creates fragility, digitalisation is becoming a maintenance capex in other words, there is no alternative.

The underappreciated European advantage in digitalisation

Much of the focus with respect to innovation has quite correctly been on advances in software engineering and thus Silicon Valley. But innovation cycles are very long so it is easy to miss the point where innovation also starts to emerge in areas or regions from which one is not used to expecting it.

We’re not suggesting Silicon Valley is going away, just that sustainability and digital climate innovation is emerging elsewhere too. Europe is rife with that given the regulatory pressure and the continuous emphasis on a manufacturing-centric economy going as far back as the industrial revolution. Without an abundance of land and natural resources, Europe has always had to be on the industrial frontier to survive with decarbonisation and digitalisation likely to be the next leg.

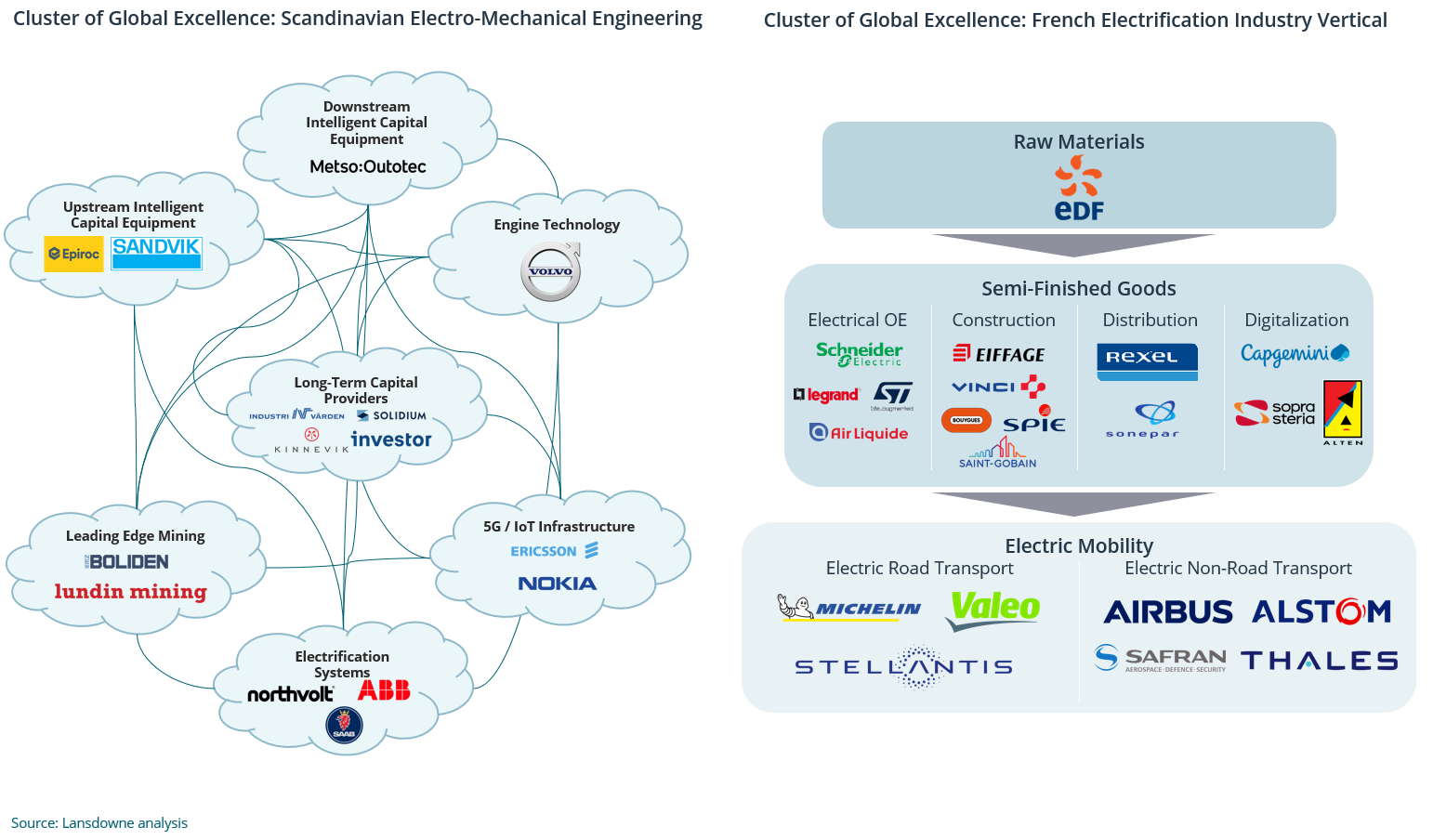

We would like to point out two European clusters of excellence that we think are often overlooked. The density of innovative companies operating within each other’s value chains provides for synergistic benefits that make the sum of the interactive nodes adding up to a greater whole. The first is the French electrification industry vertical. Possibly as a consequence of state prioritisation of nuclear and defence, the electrification industry in France is globally leading in quite a number of cases. The second industrial excellence cluster can be defined broadly as the Swedish mechanical capital equipment industry. Global leadership has been established as a consequence of long-term family capital from the likes of Investor AB and Industrivarden in combination with cheap renewable energy and consistent investment in R&D over very long time periods. The nexus extends across electrification systems to leading edge mining, autonomisation as well as 5G/IOT infrastructure providers.

Underappreciated Competitive Advantage: Scandi Mechanical and French Electrical Clusters

The opportunity set in digitalisation

Nearly all manufacturing industries must create leaner cost structures to free up the funds to invest in the extra R&D and capex required to mitigate carbon-intensive methods of production. EIBIS estimates that less than 50% of European firms are even partially digitalised with $140bn cost saving potential just from the banking sector alone. In that sense, digitalisation is a direct funding source of decarbonisation and a mandated acceleration in the latter requires a similar step up in the former. Companies that represent the picks and shovels for the digital transformation of the corporate landscape, e.g. IT services are particularly well placed.

We see multiple bifurcations taking place across the European corporate landscape. As we mentioned in our blog on decarbonisation, one dimension is between climate solution providers versus heavy carbon emitters. The second dimension is between those able to invest in digitalising versus those that can’t. In the portion of the Venn diagram comprised of digital leaders in climate friendly industries, a virtuous flywheel affect is rapidly accelerating where digitalisation and decarbonisation is really improving terms of trade.

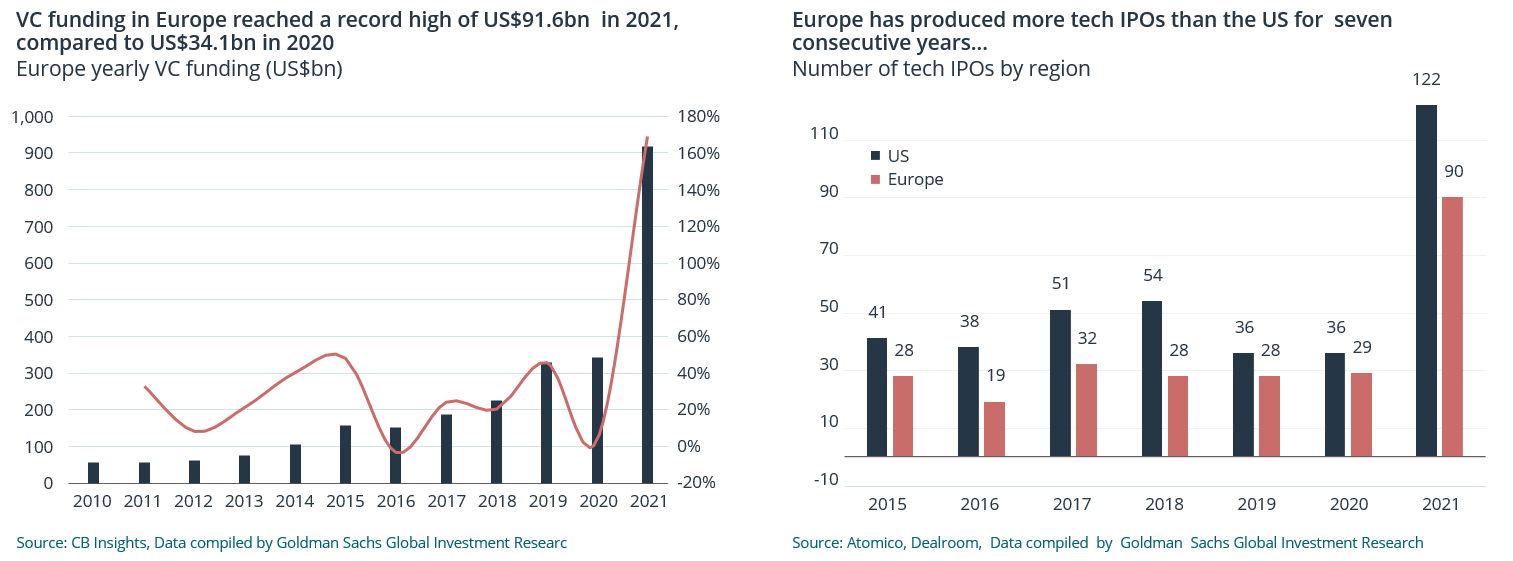

The pandemic has catalysed a compressed digital transformation in Europe from a previously quite pedestrian pace. Some industries have moved forward several years. Large pockets of Europe’s market cap is ripe for tech disruption, like it was in the US, with several disruptive business models increasingly gaining critical mass post-COVID. VC investment into Europe has more than tripled vs 2018 and there are now more tech IPOs in Europe than in the US.

We are weary of some big incumbent legacy sectors. For example, neo-brokers undermine the fee income of traditional banks, food delivery platforms undermine the weekly shop as well as the convenience top up for the food retailers while digital amino acid sequencing portends a breakthrough in the alternative protein industry that threatens the entire agricultural value chain. Similarly we understand that auto OEMs look like they are on low P/E multiples but their combined R&D budget can be matched by the likes of Tesla issuing a few percent of new shares.

Conversely, we are very focused on the mid cap space today where some of the new innovation leaders feel like they have achieved sustainable scale from which to aggressively launch off from. We invite the reader to get in touch to discuss this theme further.

Disclaimer: The views expressed herein are the views of the European Long Only team and not necessarily of Lansdowne Partners (UK) LLP as a whole. The content of this Article has been prepared by the European Long Only team alone and is not, and has not been endorsed or approved by any other person. The article and the information, statements, opinions, interpretations and beliefs contained in it are those of the European Long Only team and are provided in good faith, but no representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the contents of the Article, and no person shall be entitled to place any reliance on the Article or its contents. This Article is not intended to be, nor should it be construed as, investment, financial, tax or legal advice, or a recommendation to buy, sell or hold any security or other investment or pursue any investment strategy. Neither this letter nor any of its contents constitutes an inducement, offer or solicitation to purchase or sell any securities.

More Insights

Daniel Avigad explores what Europe can learn from Argentina’s radical reinvention under President Milei.

23 October 2025

Peter Davies spoke with Christian Mayes at Portfolio Adviser, who was interested to hear his views on why we believe UK banks represent a compelling contrarian opportunity

10 September 2025

Daniel Avigad discusses how political fragmentation and shifting regulatory structures are reshaping European investing and creating potential for long-term renewal.

28 August 2025