There are two major investment opportunities in European equities, in our view. Neither are cyclical, both are structural. After two decades of analysing this market, our conclusion is that the most relevant investment framework is through the prism of industry and company-specific capital cycles.

Much like the life-cycle of humans, we believe companies experience capital cycles with three major phases; infancy, adolescence and maturity. In each of these phases, supply and demand develop and interact in unique ways. For example, a structural demand-side opportunity is sometimes present in the Infancy stage of the capital cycle where demand for a company’s products in its early stages exceeds that which is discounted. Conversely, a structural supply-side opportunity can manifest for investors when an industry evolves from the Adolescence stage of the capital cycle to Maturity via capacity withdrawal or consolidation.

To identify potential shifts in the terms of trade of a company versus its stakeholders, and thus a movement within its capital cycle, we constantly look for any of four catalysts. These relate to change; in regulation, cost of capital, technological disruption or in consumer habits (utility of demand).

Investment Philosophy: Structured Approach to Identifying Where Demand > Supply

Three Stages of the Typical Industry Life-Cycle

As the drive towards Net Zero is fuelled by regulation, disruption and consumer attitudes, i.e. three of the four catalysts above, it represents a very powerful example of the ways in which capital cycles are being impacted at this juncture in the global economy. We think it also illustrates how our long-standing investment approach (as outlined above) is potentially gaining in practical relevance in current market circumstances.

In two blogs we share our views on what we think are two of the most powerful structural demand-side themes that are shaping industries today: decarbonisation and digitalisation. In this first blog we will discuss our views on the impact of decarbonisation. We draw here on a webinar we held in November (for this more detailed version, available for clients on request).

The persistence of the decarbonisation theme

The motives powering decarbonisation appear of a highly persistent nature. It’s not a fad but rather the early stages of a multi-year cycle.

The science suggests that a climate crisis will result from inaction. From an investment perspective, the critical point to note is the structure of this problem is one of an in-built time decay function. If society doesn’t act now, the consequences just get worse in the future. In a way this provides a natural hedge for investors. The less that is done now, the more the value of the services of solution providers will commensurately increase in the future.

At the more abstract or real-politik level, we think policymakers have little choice now other than to do massive stimulus centred around the climate. Faced with a debt and inequality crisis, and austerity having proven not to be a vote winner, the most expedient next step is major stimulus. The G in ESG represents Governance which has been of so low quality that a massive surplus investment in E, the Environment is required to bail out the policymakers.

With respect to Governance failure, it seems fair to us to say that that this has repeatedly been evident across most stakeholders. Capitalism has been too short-termist, labour unions too myopic, regulators too hubristic and politicians too expedient. At the root of all of this is the agency-like actions of people who were appointed to behave as principals in their various roles. Since this is unlikely to reverse any time soon, decarbonisation-related stimulus is very likely here to stay.

Carbon pricing as the mechanism to decarbonise in Europe

The European Union has been at the forefront of climate regulation. The key mechanism it has embraced to enforce the transition has been the pricing of carbon dioxide through the Emissions Trading System (EU ETS) scheme. We started investigating upcoming changes in this system in 2017 and made several investments on the basis of our belief that the carbon price of c€5 per tonne was unsustainable. Today the price is approaching €100.

We have a view that carbon is not a traditional commodity but rather a political commodity. The supply of carbon certificates is determined by EU policy and subject to periodic review. What matters most is therefore what price level the EU deems to be consistent with achieving its policy objectives such as Net Zero by 2050.

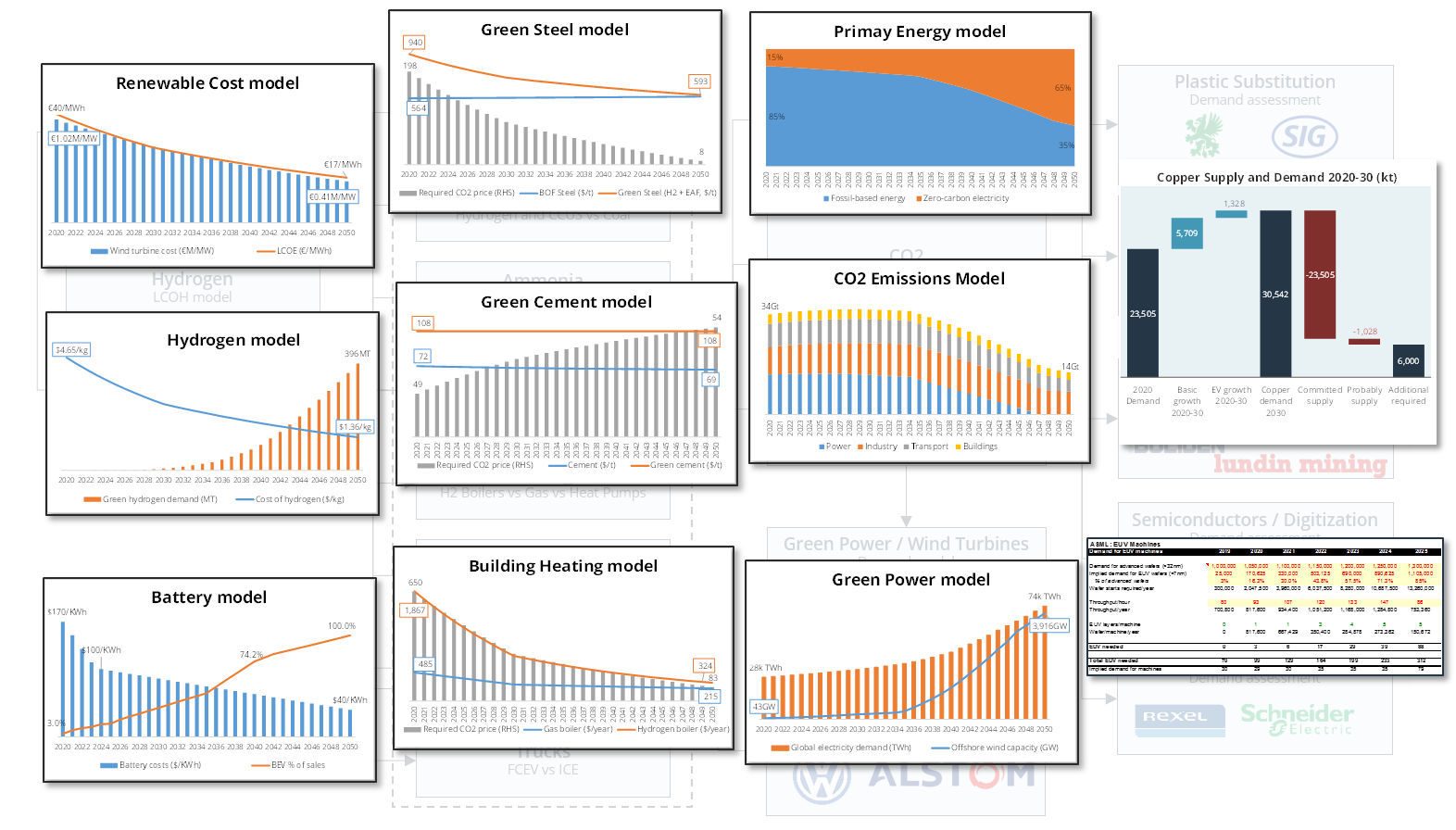

With this in mind, we have built a set of 20 interacting bottom-up industry models, each for a highly carbon-emitting sector. We have tried to assess the price that carbon must rise to for each industry to have the economic incentive to switch to a zero-carbon alternative form of production. In aggregate, this allows us to construct a carbon cost curve.

Global Net Zero Scenario: 20+ Interacting Models, Analytical Barriers High and Rising

Our key conclusion is that any hope of achieving Net Zero by 2050 requires 3 simultaneous developments in the very near term (see this earlier blog on the topic):

- A carbon price of well over €100 per tonne is required very soon

- To decarbonise, we must first electrify on a massive scale

- Nature-based solutions like trees aren’t viewed nearly as importantly as they should be (see this earlier blog on the topic)

Opportunities (and risks) for investing in a world of expensively priced externalities

The impact of carbon prices well in excess of €100 per tonne are not at all well discounted by equity markets in our view. We expect a bifurcation between the cash flow of carbon solution providers versus heavy emitters accompanied by a widening in their relative cost of capital. So both earnings and valuation multiples are likely to diverge.

Examples of this can be found in the mining space. We believe the strategic value of European copper mines to be fundamentally mispriced. Europe’s decarbonisation strategy is dependent upon copper for the transition to electric vehicles and renewables and a single Swedish producer in which the fund is invested accounts for 1/3rd of the Continent’s total domestic production. We think Europe desperately needs more domestic copper and producers that can satisfy this demand are well-positioned in this regard. Additionally, Europe is due to impose a carbon border tax in coming years which will rejig the copper cost curve to the benefit of domestic producers. Given the proximity of mines in Scandinavia to the European customer base, as well as its renewable energy supply, the carbon footprint of its production is a fraction of that of South American competitors. Under this cost umbrella, we think cash flows and capital returns are potentially vastly underestimated.

Within Europe, we see a lot of such opportunities. European companies have been subjected to the most draconian environmental regulation in the world. As a consequence, many are now the innovation leaders in climate solutions. Today only 20% of global carbon emissions are regulated, but we think this will increase a lot and we see many countries signing up to Net Zero. To the extent they do, the addressable market for Europe’s climate champions will substantially expand which for quite a number is not very well discounted.

However, we are cautious about going out and buying all the ‘ultra-green’ stocks out there. It is important to recognise that the burden from achieving climate sustainability is not likely to be spread equally and pain points may constrain progress or inadvertently derail it long before Net Zero is achieved. There is an incompatibility of claims between the elderly and youth given the unaffordable nature of generous pensions and climate investments simultaneously. Also we see opposing needs between Europe and its raw material suppliers, with highly carbon intensive developing markets with respect to carbon border taxes, within the EU between countries with different energy mixes, between large and small companies, savers and debtors and so on and so forth… We doubt Net Zero will be achieved at least on time.

This disequilibrium between the needs of various parties makes us weary of venturing into the hyped universe of new technology meme stocks. Highly subsidised unproven technologies like hydrogen are expensive for example and society may not be able to afford to pay for it forever. We estimate that the cost of achieving Net Zero is equivalent to several thousand euros per consumer per year or about 1/3rd of annual household savings. In a recent blog post, we argued that nature based solutions such as trees represent a very low cost and 400 million year old technology for removing carbon emissions. At a carbon price of €15 per tonne, we estimated attractive IRRs.

We would far prefer to bet on proven low-cost solutions at the low end of the carbon cost curve than over-owned unproven technology bets that are at the high end.

Disclaimer: The views expressed herein are the views of the European Long Only team and not necessarily of Lansdowne Partners (UK) LLP as a whole. The content of this Article has been prepared by the European Long Only team alone and is not, and has not been endorsed or approved by any other person. The article and the information, statements, opinions, interpretations and beliefs contained in it are those of the European Long Only team and are provided in good faith, but no representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the contents of the Article, and no person shall be entitled to place any reliance on the Article or its contents. This Article is not intended to be, nor should it be construed as, investment, financial, tax or legal advice, or a recommendation to buy, sell or hold any security or other investment or pursue any investment strategy. Neither this letter nor any of its contents constitutes an inducement, offer or solicitation to purchase or sell any securities.

More Insights

Daniel Avigad explores what Europe can learn from Argentina’s radical reinvention under President Milei.

23 October 2025

Peter Davies spoke with Christian Mayes at Portfolio Adviser, who was interested to hear his views on why we believe UK banks represent a compelling contrarian opportunity

10 September 2025

Daniel Avigad discusses how political fragmentation and shifting regulatory structures are reshaping European investing and creating potential for long-term renewal.

28 August 2025